Hate maths? Love holidays? Read on

As the Christmas decorations went up, so did my dread. I’d tried to be good about setting aside tax for the January HMRC deadline. But, once again, I was raiding my personal savings to make up the difference. Why couldn’t I be more organised. Why?

Hello. My name’s Helen and I was a business finance phobic. Five years into being a freelancer my Achilles heel was finance.

I now recommend using Profit First for UK freelancers. It’s a free and simple financial strategy which has transformed how I run my business.

What sort of UK freelancer or business suits Profit First?

Ever feel like you have nothing to show for all your hard work? Do you scramble around when it comes to paying your tax? Only have a vague grasp of how much it costs to run your business? This is the financial system for you.

The Profit First principle in a nutshell

When an invoice is paid, instead of keeping it in one account, you divide it up into different areas. And you pay yourself a profit first, hence the name. You can also see it as Bonus First, if ‘profit’ means something different to you.

The idea is based on behavioural science and, more specifically, Parkinson’s Law which states:

“Work expands so as to fill the time available for its completion.” – C. Northcote Parkinson

It also applies to our relationship to scarcity. Profit First creator Mike Michalowicz talks about how careless we are with a full tube of toothpaste compared to one that’s nearly finished.

When we see a zero balance, it makes us more frugal. The truth is we don’t have zero. We’ve squirreled away money for our bills and wages. But if it’s not obvious, our brain acts like we don’t have as much.

The book Profit First by Mike Michalowicz is a pacey, honest and sometimes funny read, plus a great reference source.

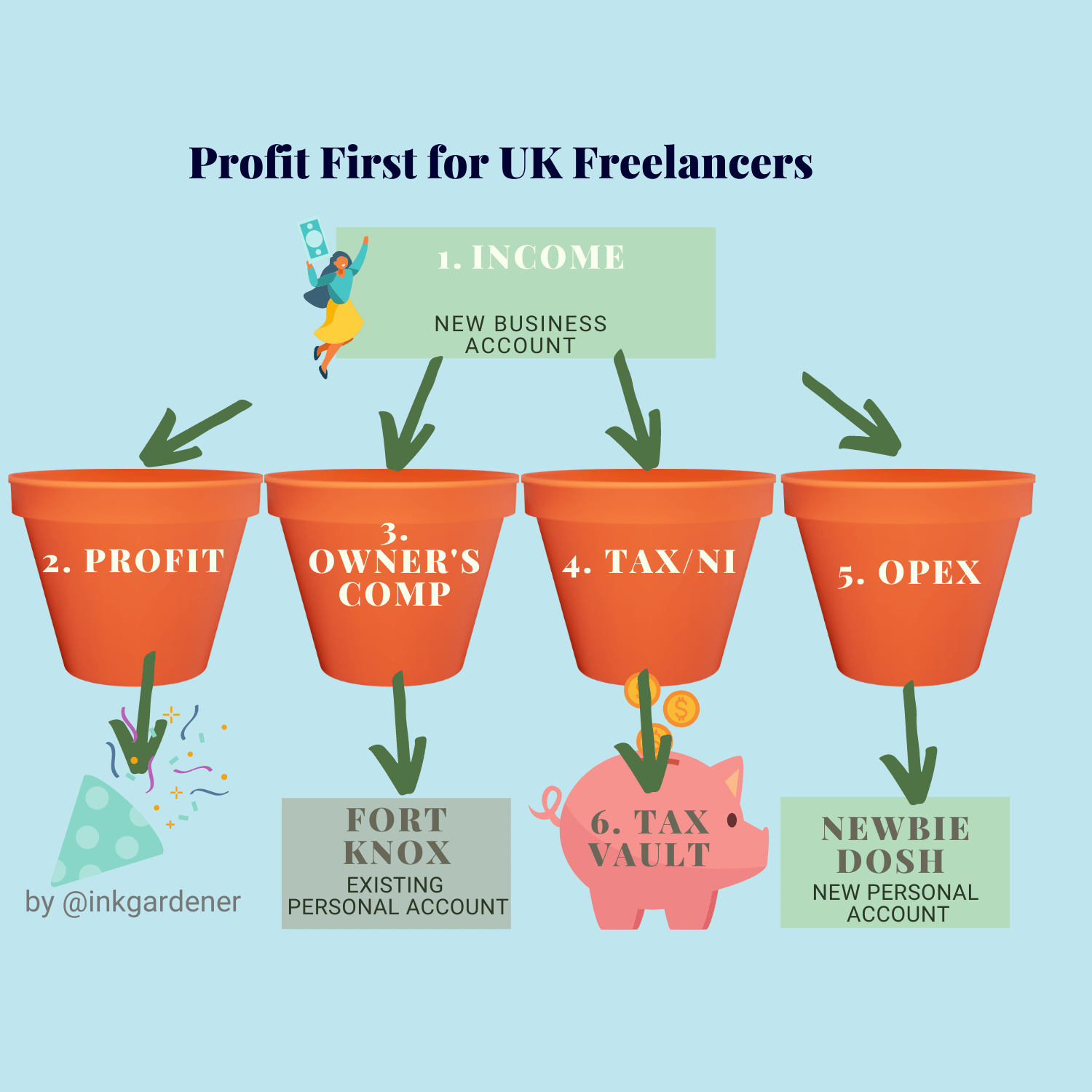

The Profit First bank accounts you (theoretically) need

Mike recommends setting up five separate bank accounts, plus two optional ones:

- Income – the business bank account where the money comes in

- Profit – the bonus or reward for your hard work

- Owner’s Compensation – as in your wage

- Tax

- Operating Expenses – such as printer ink, insurance and subscriptions

- Tax Vault (optional)

- Profit Vault (optional)

In the end, I set up just two new bank accounts, plus a savings account for 6. Tax Vault. Here’s the why and how:

Profit First and UK bank accounts – my workaround

In America, it may be that you don’t incur bank charges for accounts. But it’s not so simple for UK business banking.

However, as my new online bank Monzo offered separate saving ‘pots’, I stumbled across an easy workaround.

Dealing with 1 to 4

Clients pay their invoices into my 1. Income account – the official business account. Within it, there are ‘pots’ for 2. Profit, 3. Owner’s Compensation, and 4. Tax. So far, so good.

But a 5. Operating Expenses savings pot wouldn’t work as I need to pay Direct Debits. So needed another current account.

Solving 5. Operating Expenses

When you request a business account with an online bank, they usually ask you to open a personal current account first. But my existing personal current account – codename Fort Knox for the sake of this article – was fine. Why did I need another account?

Then – light bulb moment! This new personal current account – let’s call it Newbie Dosh – could be my business’s Operating Expenses account.

A word about Tax Vaults and Profit Vaults

6. Tax Vault: It’s surprising how quickly tax racks up. Mike advises stashing it away every so often in an account which is awkward to access. Perhaps postal only or which penalises you for each withdrawal? That way you won’t be tempted to spend what is the government’s money, not yours.

I keep mine in Premium Bonds, which needs around 10 days’ notice for withdrawals. Prizes are tax-free too. Handy to know if you win big!

7. Profit Vault: You can do this with Profit too if you’re saving for something significant.

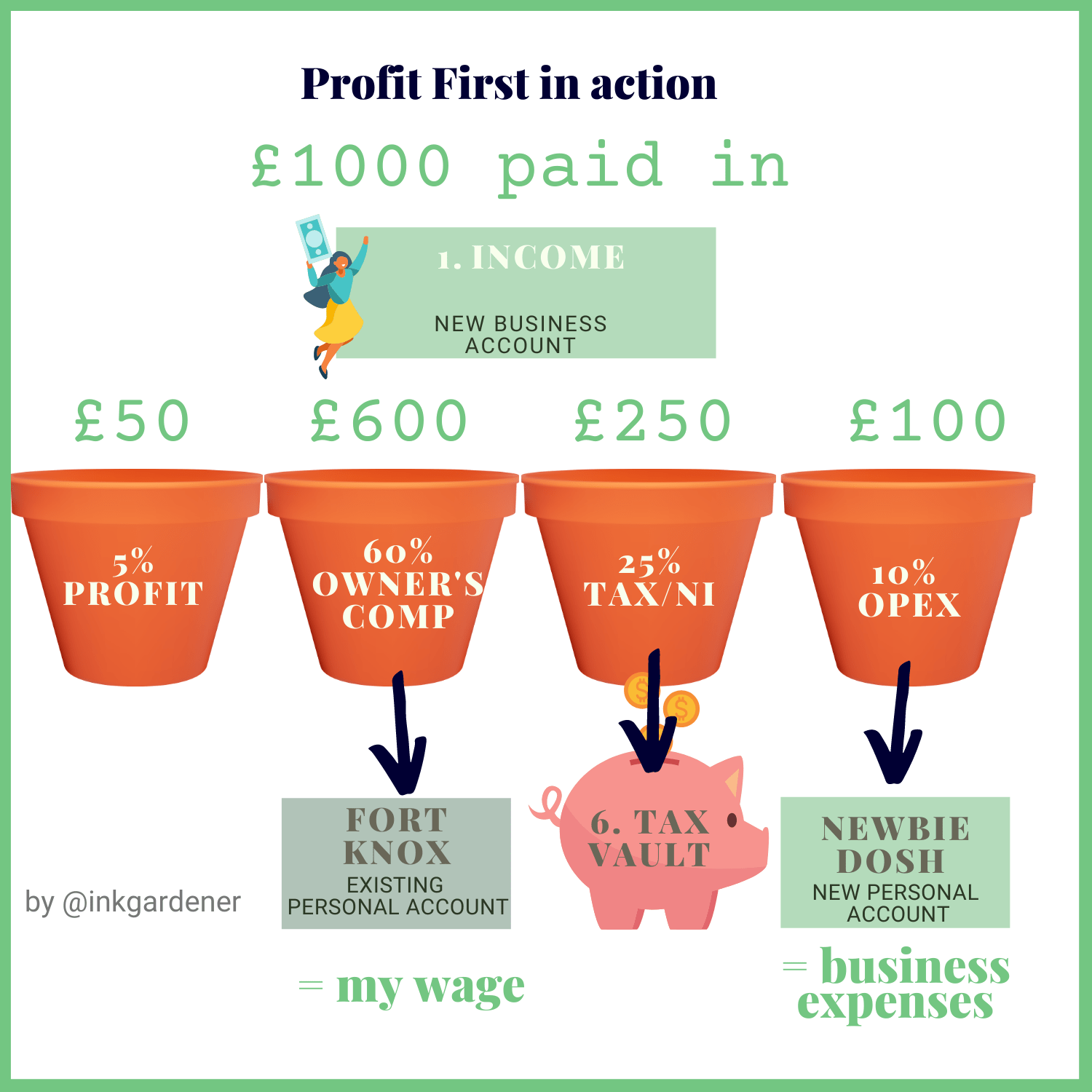

How Profit First works in practice

My client pays their £1000 invoice into 1. Income – as in my Business Account.

I hive off the following to ‘pots’ within it:

- 5% of the £1000 goes to my 2. Profit pot – so £50

- 60% to 3. Owner’s Compensation pot – so £600

- 25% to my 4. Tax/National Insurance pot – so £250

- 10% to my 5. Opex – as in Operating Expenses – pot – so £100

This means I’ve cleared the ‘plate’ of the main business account and the balance is £0. But that’s OK, as I have money to cover my business expenses and tax.

Every fortnight or so I then transfer whatever is in the Opex pot to my Newbie Dosh account.

Here’s a diagram with figures:

Why these percentages work for me

5% Profit

This is admittedly high for Profit First. Mike recommends starting with 1%. I could have done this, and then taken 64% for Owner’s Compensation.

But because Profit is stored within my business account, I don’t see it as a personal savings pot. Plus it’s lovely for Ink Gardener Copywriting to send me on holiday as a ‘bonus’.

60% Owner’s Compensation

Better known as wages. It’s just easier to follow Profit First if you stick with Mike’s labels.

If I change any of the other percentages, this is the area that takes the hammering / gets the bonus.

Tip: I used to ransack the entire pot in one go. But now I transfer a weekly wage into my Fort Knox account. This makes personal finance budgeting easier. Also there’s the reassurance I have X number of weeks covered if a work lull hits.

25% Tax/NI

I’m a UK basic rate tax payer so assumed this should be 20%. But you MUST account for National Insurance Class 4 contributions. These are 6% on any profits over £12,500 ish. Check out Self-employed National Insurance by gov.uk for the current rate.

Your Personal Allowance means tax/NI is not exactly 20% tax for everything. And Payments on Account make it tricky to work out how much you will actually owe HMRC from one year to the next.

What are Payments on Account? Once your profits exceed £1,000, HMRC will ask for advance payments of half your previous year’s tax bill in January and July .

Hollies Bookkeeping suggests 30% to set aside for tax and National Insurance. But so far 25% has covered everything.

I put aside money from every transaction, starting from 1 April onwards. Because of the Personal Tax Allowance, this usually means the pot is overflowing, and I can pay the excess back to myself. Another incentive to do my tax return as early as possible.

10% Operating Expenses

15% was too much. 7% too little. 10% is just about right. As a freelance copywriter, I don’t have to buy stock. However there is business insurance, subscriptions, website hosting, software and printer ink. And Pilot pens. Lots of Pilot pens!

As the Newbie Dosh account is a personal current account rather than a savings account, it can deal with Standing Orders and Direct Debits. I make sure its balance is always in the black, with enough to cover the two largest monthly pay-outs at any one time.

Within it, I’ve set up other dedicated ‘pots’ such as ‘Accountant fees’. It’s a good way to save up throughout the year for significant, one-off costs.

Operating Expenses refunds any expenses made by my personal Fort Knox account. For example when I pick up printer paper at the supermarket.

Profit First and UK freelancers – which bank account should you use?

I love the ‘pots’ system of Monzo. Their customer service is also really helpful, speedy and friendly. Use this link and and we’ll both get £50 when you open a business account. And £5 each when you open your personal account for expenses (if you spend on your card within 30 days plus some other Ts and Cs) : Link to welcome bonus for Monzo

Other Profit-First friendly banks

-

- Lloyds Bank

- Revolut – known as accounts within the current account

- Starling Bank – but as they mucked up my application, I’m reluctant to recommend them

Have I missed yours off the list? Please email me at helen [at] inkgardener.co.uk or tweet me at @inkgardener and I’ll add it on.

Frequently asked questions

Here are a few questions that have come up when I’ve explained Profit First for UK freelancers:

“I’m not sure. Is it difficult to do?”

Not at all! Honestly, percentages are a doddle to work out. And the peace of mind it gives you is priceless. Use the online percentage calculator website if you’re really struggling.

“Can I change these percentages?”

Absolutely. It’s up to you. Every business is different. The Profit First book gives more suggestions.

The brilliance of Profit First is how it shows you whether your business is viable. You can’t cheat the percentages. If you don’t earn enough you need to cut your expenses or find more work.

“Can I use set amounts rather than percentages?”

You can, but then it’s not Profit First. It’s the percentages which are the game-changer. In a ‘feast’ month, you put more in. So when a ‘famine’ month comes along, you’re covered.

“Can I move money between the pots?”

Yes, although I only do it if there’s a big surplus in Operating Expenses. And hands off that Tax pot!

“Should I wait until I’ve actually earnt something decent?”

Lots of new business owners say they’ll think about this later. But it’s best to implement Profit First from the start. You’re then in the habit when you start getting busy with clients. Even when just £100 comes in, buying a slightly fancier ice cream with your ‘Profit’ helps incentivise you.

A basic level business account with Monzo or Starling is free, so it’s not like you’re spending unnecessary money.

Cautionary tale: haven’t yet set up a business account? I know that for sole traders in particular, it’s tempting to use just your personal account. But a business account will make running the business SOOOOO much easier, I promise.

Also, during the pandemic, the government would only pay out certain business loans to business bank accounts, not personal accounts. Don’t get caught out.

“Does ‘1. Income’ deal with turnover or profit?”

Turnover. Don’t know the difference? Check out my How to become a freelance copywriter article with tips for freelancers and start-ups.

“I just can’t see the logic in the system.”

Ah, the classic “Not so much a question, more of a statement.”

Fair enough. Profit First can be a bit Marmite and isn’t for everyone. If traditional book-keeping works for you, then by all means continue.

“How did your accountant react?”

To quote his email: “I am impressed!”

I only had to send him Excel spreadsheet versions of my 1. Income business account and my expenses (Newbie Dosh). It was such a relief to get the accounts to him early. It meant I knew exactly what to pay HMRC in July and the following January.

However there are Profit First accountants and book-keepers you can switch to if yours isn’t keen on it.

Want to find out more about Profit First for UK freelancers?

Here are some other UK businesses that are raving about it:

- How I use The Profit First System to run my business – Hazel Whicher. This also includes her Payments on Account shock and how she solved it.

- Best Bank for Profit First – Annette & Co.

- A Profit First Success Story – Raffingers Accountants

Let me – and Mike – know how you get on

I wrote this article to share the awesomeness of Profit First for UK freelancers. If you’ve any questions, please tag me @inkgardener and Mike – @MikeMichalowicz – into a tweet. I’m in no way affiliated to him, I just think it’s a cracking solution!

About the author

Helen Reynolds is a freelance copywriter with more than 25 years’ experience of writing for digital platforms. Helen presented her Maths teacher with her ‘My Horriblest Subject Is Maths’ poem on the final day of term. She now uses her ‘Favouritest’ subject of English to create or refresh websites with customer and Google-friendly web content.

Based in York, Helen helps businesses across the UK. Find out more about her freelance copywriter services.